The smart Trick of Feie Calculator That Nobody is Talking About

Table of ContentsWhat Does Feie Calculator Do?All About Feie CalculatorEverything about Feie CalculatorTop Guidelines Of Feie CalculatorWhat Does Feie Calculator Do?

He marketed his U.S. home to develop his intent to live abroad permanently and used for a Mexican residency visa with his better half to assist satisfy the Bona Fide Residency Examination. Neil directs out that purchasing building abroad can be testing without very first experiencing the area."It's something that people need to be really attentive concerning," he claims, and recommends deportees to be cautious of usual errors, such as overstaying in the United state

Neil is careful to stress to Stress and anxiety tax authorities that "I'm not conducting any performing in Illinois. The United state is one of the few nations that tax obligations its people regardless of where they live, implying that even if an expat has no income from U.S.

tax returnTax obligation "The Foreign Tax Credit permits individuals working in high-tax countries like the UK to offset their United state tax obligation obligation by the amount they've already paid in tax obligations abroad," says Lewis.

More About Feie Calculator

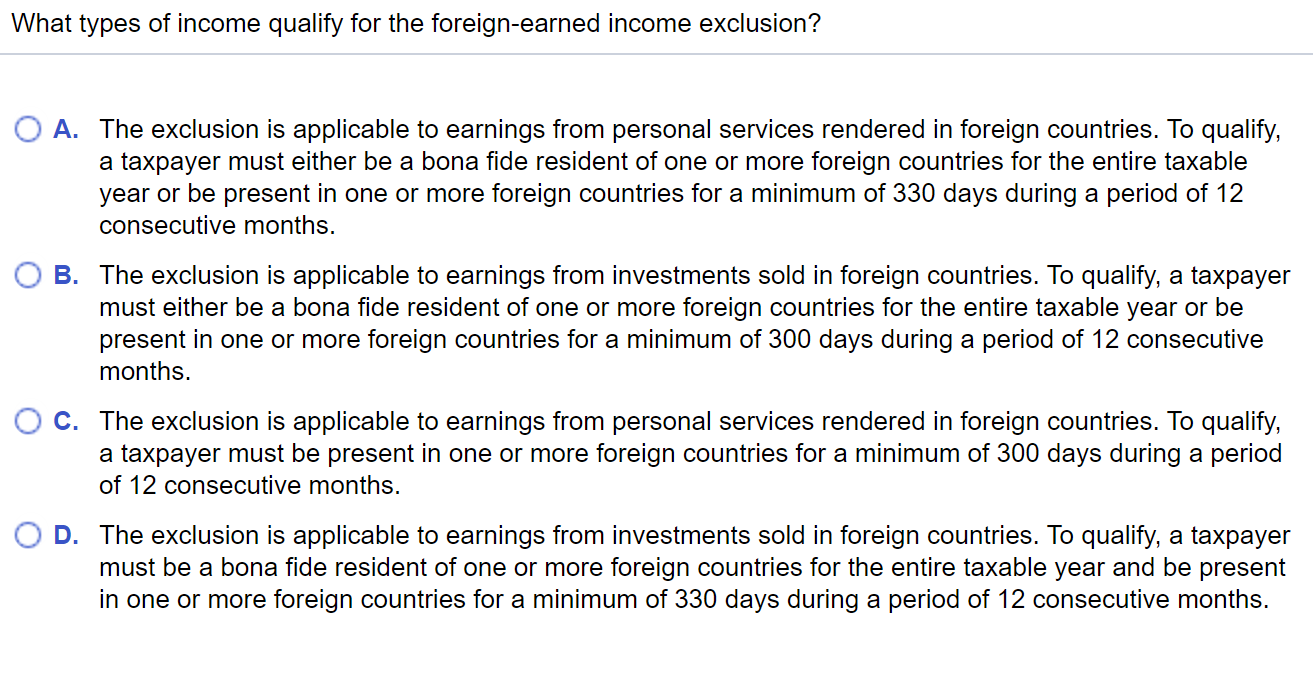

Below are some of the most regularly asked inquiries concerning the FEIE and various other exemptions The Foreign Earned Revenue Exemption (FEIE) enables united state taxpayers to exclude as much as $130,000 of foreign-earned earnings from government income tax obligation, lowering their united state tax liability. To receive FEIE, you should meet either the Physical Presence Test (330 days abroad) or the Authentic Residence Examination (show your main home in an international nation for a whole tax obligation year).

The Physical Existence Examination needs you to be outside the U.S. for 330 days within a 12-month period. The Physical Existence Examination likewise calls for U.S. taxpayers to have both an international income and a foreign tax obligation home. A tax home is defined as your prime area for organization or work, no matter your family's residence.

The Basic Principles Of Feie Calculator

An income tax obligation treaty between the united state and you can try these out another nation can help protect against double taxes. While the Foreign Earned Earnings Exclusion lowers taxed earnings, a treaty may provide fringe benefits for qualified taxpayers abroad. FBAR (Foreign Savings Account Record) is a needed declare U.S. residents with over $10,000 in foreign economic accounts.

Eligibility for FEIE depends on meeting certain residency or physical existence examinations. is a tax obligation advisor on the Harness system and the founder of Chessis Tax obligation. He belongs to the National Association of Enrolled Professionals, the Texas Culture of Enrolled Agents, and the Texas Society of CPAs. He brings over a decade of experience helping Big 4 firms, suggesting expatriates and high-net-worth people.

Neil Johnson, CERTIFIED PUBLIC ACCOUNTANT, is a tax obligation consultant on the Harness system and the owner of The Tax Dude. He has more than thirty years of experience and now specializes in CFO services, equity settlement, copyright tax, marijuana taxation and separation related tax/financial preparation issues. He is an expat based in Mexico - https://www.easel.ly/browserEasel/14596896.

The foreign made income exclusions, sometimes described as the Sec. 911 exclusions, omit tax on wages gained from functioning abroad. The exemptions comprise 2 components - an income exemption and a real estate exclusion. The adhering to Frequently asked questions review the benefit of the exemptions consisting of when both partners are deportees in a general manner.

Not known Details About Feie Calculator

The tax obligation benefit leaves out the revenue from tax obligation at bottom tax obligation rates. Previously, the exclusions "came off the top" reducing revenue subject to tax at the leading tax obligation rates.

These exclusions do not spare the incomes from US taxes however simply offer a tax obligation reduction. Note that a solitary person working abroad for every one of 2025 who earned about $145,000 without other income will certainly have gross income lowered to no - successfully the exact same solution as being "free of tax." The exemptions are computed on a daily basis.

Comments on “The Greatest Guide To Feie Calculator”